On a scale of 1 to 10, our high ranked DRA scores indicate the likelihood that a company, anywhere in the world, will not settle its debts.

Yes, I would like to see an exampleCofaCheckGreater security for you

Why it is better to check with Coface

CofaCheck is effective financial risk management tool that safeguards your company against losses sustained arising from non-payment of trade related debts.

Knowledge is key: check your customers', prospects' and suppliers' risk levels.

Our extensive information network provides critical real-time insights when you need them. This makes it easier to grow your business, respond to critical risks and prevent bad deals.

Minimise the

risk of non-payment

Determine which customers are reliable, set realistic credit limits and check the risk of non-payment.

Protect your supply chain

Your business depends on your supplier's financial health. Be the first to know about global or local problems and check each link.

Reach new

markets

Access the latest information on new and existing markets. This will make it easier for you to create growth opportunities.

On what do we base our forecasts?

With offices in 48 countries we are uniquely positioned to provide valuable insights into every sector, country and emerging market.

Therefore, you can act with confidence anywhere in the world.

- We monitor 80 million companies in 200 countries.

- Data is adjusted by country, sector and current economy.

- You will have immediate access to crucial insights that you will not find elsewhere.

With which tools

do we make the difference at

Coface?

Before you confirm a deal, check your supplier's, prospect's or customer's risk level with our unique solutions:

Risk assessment.

Credit advice.

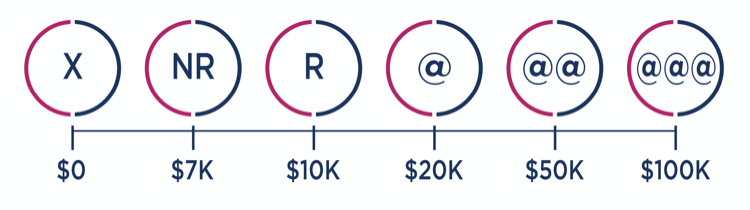

The online instant standard @Rating Credit Opinion classifies the creditworthiness of companies on a 6-level scale:

In addition, @Rating is also available - both Monitored, with online alert or Customized, with personal advice by a Belgian expert (for a portfolio above €100, 000).

Yes, I would like to see an example

Information reports.

Recommended credit limits for a company, based on its trading history, management information and general financial health. Taking into account the risks associated with the sector and country in which the company is based.

Yes, I would like to see an example